Posted on: 3 July 2020

Clarksons Research has issued its latest review of the shipping market context, Covid-19: Shipping Market Impact Assessment, the full version of which is available to download on Shipping Intelligence Network.

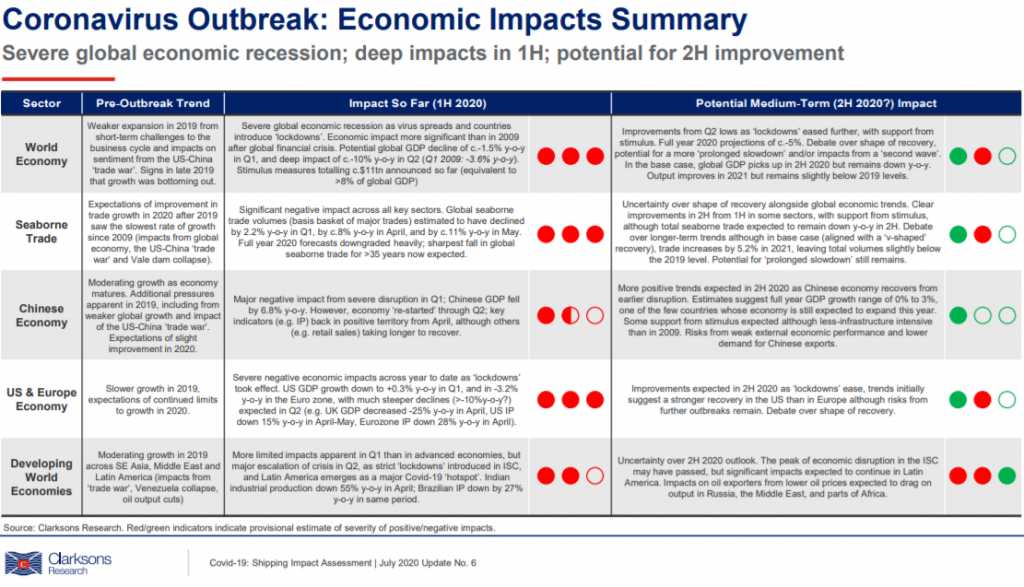

With provisional mid-year data points available, the aim of this briefing is to continue to provide a framework to help understand and monitor the huge impacts of Covid-19 in the shipping market context. The review also includes analysis of a range of newly developed high frequency and near time data, including a new Summary Tracker that will be updated each week (see image below).

Summarising the briefing, Steve Gordon, Managing Director of Clarksons Research, commented: “The severity of the Covid-19 economic “shock” on the shipping industry is becoming clearer: we estimate seaborne trade fell by 10.6% y-o-y in May and our annual projections suggest trade will contract by 5.6% across 2020, representing 1bn tonnes of “lost” trade and the sharpest decline for over 35 years. There are however tentative signs that we may be passing “peak” impact, with our daily global port call activity index showing a “bottoming” out (-9.9% y-o-y in May, -7.4% y-o-y in June) while in China, shipping’s biggest market, there is already normalised port activity and increasingly positive economic news. Our range of recovery scenarios illustrate that huge multi-year risks remain and signal a continued difficult and “bumpy” road ahead, but also the potential for further examples of disruption upside: perhaps “windows” of improved rates as markets deal with inefficiencies and large swings in month to month demand.

“Despite a now weakening trend, our cross sector ClarkSea index recorded its strongest first half period for 10 years, averaging $16,373/ day (up 39% y-o-y and 33% above the 10 year average). Across the shipping segments, variations and complexities continue: while deep and specific challenges in Cruise, Ferry (port callings are down 45% y-o-y), PCC and Offshore remain, the tanker market is now winding down but from an excellent cash position; container volumes have been hit hard but capacity is being well managed for the moment (idle capacity sits at 9.3%, down from 11.8% in May) and perhaps bulkers may have a better 2H with “windows” of good rates.

“The briefing also deals with data points around the 20% y-o-y decline in shipbuilding deliveries but now improving productivity, a shrinking newbuilding orderbook, slowly returning activity to the demolition and sale and purchase markets, the now “vulnerable” scrubber retro-fitting program and debate about how mega trends such as technology and the Green Transition may play out and “amplify” post Covid-19. We have also updated our comparison with the situation during the financial crisis: potentially a significantly deeper initial impact but sharper rebound; a smaller newbuild orderbook (10% of fleet not 50%); lower pre-disruption trade growth; better capitalized banks; different megatrends. Our continued very best wishes to our friends and subscribers in dealing with the Covid-19 outbreak.”